August 2015 Dealer Profitability

1 September 2015

Total Industry

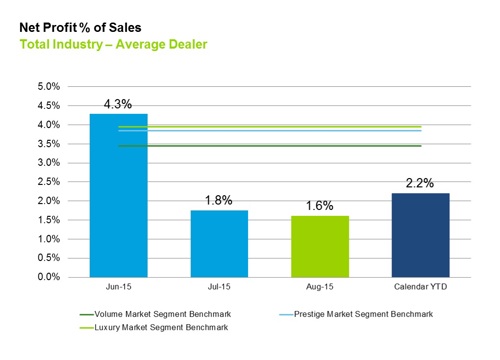

In August, the average dealer’s profitability dropped away slightly, driven by an increase in expenses per new vehicle sold, to reach 1.6% for August. This was measured at 0.6 percentage points below the YTD net profit as a % of sales for August of 2.2%.

State-by-State

Collectively, the states experienced mixed results in comparison to their July performance.

New South Wales/Australian Capital Territory

The NSW & ACT state group recorded NP%S of 1.8% and 2.1% for August MTD and YTD respectively, driven by growth in luxury and prestige profitability. Gross profits within the Service department were all down for August, offset by a relative increase in parts department gross profits.

Queensland

QLD produced the strongest growth in NP%S for August, up 0.2 percentage points to 2.1% NP%S. This has caused the YTD NP%S to remain stable since July at 2.8%. A strong performance in Finance and Insurance has caused an increase in this department’s contribution to dealership income in August.

Victoria/Tasmania

Despite stability in YTD NP%S within the Vic & Tas state group since July, NP%S for the month of August dropped away by 0.4 percentage points, to be recorded at 1.2%. This was driven by a drop in Prestige and Volume NP%S that offset growth in Luxury profitability. Finance departments worked hard in August to grow finance within their Used Vehicle departments, settling a growing number of used cars sold with associated finance contracts.

South Australia/Northern Territory

Dealers in the SA & NT state group also experienced a slight jump in NP%S, up 0.1 percentage points at 2.0% for August. This result was parallel to the slight increase in the state groups YTD performance recorded at 2.4% for August. New vehicle finance in August grew, and contributed positively to profitability when coupled with an increase in income per contract.

Western Australia

WA experienced a sharp decline in dealer profitability, down in August to be recorded at 0.3%. Though YTD NP%S for WA was slightly down at 1.5%, this figure remained relatively strong considering the weak August result for the state. Significantly fewer new and used vehicle sales contributed to this result.

Segments

All segments have experienced a shift in profitability throughout August, however the movement has only been minor.

Nationally, the luxury segment experienced positive growth throughout August, maintaining stability in the YTD results at 2.4%. This result was achieved despite fewer new vehicles sold with associated finance contracts in August.

The prestige and volume segments were less profitable in August, returning 1.6%. Movements in profitability throughout the departments were only very minor however, subsequently establishing YTD profitability since July.

Click the chart below for more details.

Dealership data contained in this document has been obtained from the eProfitFocus database. Over 800 dealers across Australia have contributed towards this data.

© 2015 Deloitte Motor Industry Services Pty Ltd

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.